Blog

All Eyes on the 6G era: what, where, and when?

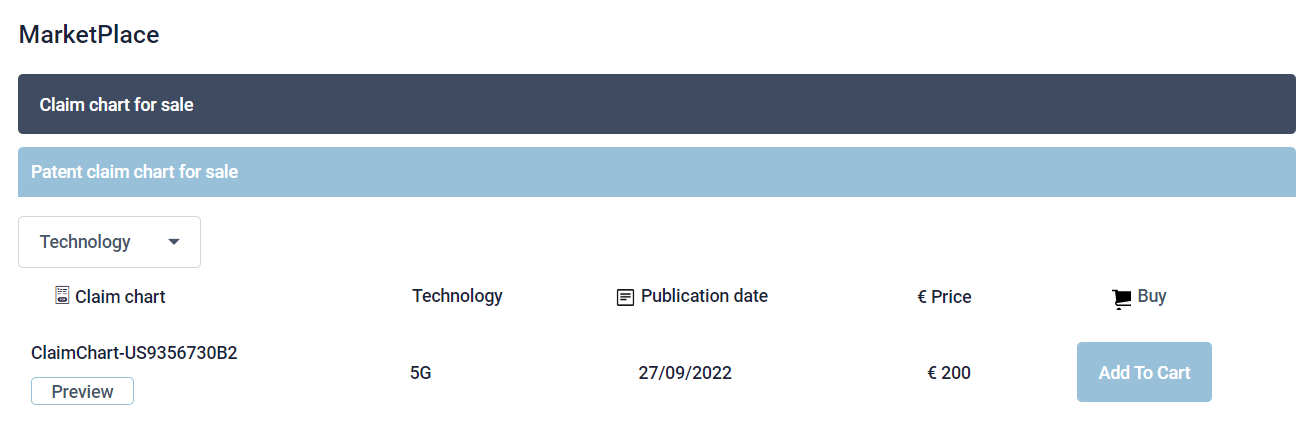

<div> <div class="pb-2 pt-2 row"> <div class="col-12"> <div class="blogmargin container text-center w-100"> <h1>All Eyes on the 6G era: what, where, and when?</h1> </div> </div> </div> <p><img class="d-block img-blog img-fluid mx-auto" src="/assets/frontend/images/blog--list-7.jpeg"></p> <div class="blog-content container pb-4 pt-4 text-justify"> <p>We are in the middle of a major 5G push with <a href="//www.gsma.com/about-us/regions/asia-pacific/wp-content/uploads/2024/01/APAC5GIC-202401-v2.pdf">connections worldwide surpassing 1.5 billion at the end of 2023</a>.</p> <p>Indeed, 5G is significantly faster than 4G LTE networks and has reduced latency, increased capacity, and bandwidth. This has meant that the transferring of a high-resolution movie can be done in a few seconds, that virtual and augmented reality applications such as Pokemon Go have become popular, and that smart cities with traffic lights changing their patterns based on traffic flows are now a reality. Its unparalleled speed (10 times faster than 4G) has also created a boom in the IoT landscape with the <a href="//www.ericsson.com/en/reports-and-papers/mobility-report/dataforecasts/iot-connections-outlook">total number of cellular IoT connections reaching around 3 billion at the end of 2023</a>.</p> <p>And yet 6G is already on its way.</p> <h3>So, what will be different with 6G?</h3> <p>There are key differences between the 5G and 6G networks in their capabilities, objectives, and the technologies they employ.</p> <p>First, the 6G network will be up to 10 times faster than its 5G counterpart. <a href="//www.ericsson.com/en/6g">This includes the capability to provide several hundred gigabits per second (Gbps) and end-to-end sub-millisecond (ms) latency. In comparison, 5G has demonstrated “peak downlink speeds as high as 4 Gbps and latency as low as 1ms”. These results will be achieved thanks to the reuse of 5G mid-bands as well as new spectrum bands in the sub-terahertz (sub-THz) and centimetre wave (cmWave) range.</a>.</p> <p>6G will also provide significantly <a href="//www.ericsson.com/en/6g"> “improved adaptability and programmability, simplified architecture design, and improved energy performance”</a>.</p> <p>Regarding network capacity, while 5G has a capacity of up to 1 million devices per square kilometre, 6G is expected to support more connected devices, including a massive number of Internet of Things devices. 6G will also go hand in hand with<a href="//www.technologyreview.com/2023/10/26/1082028/ai-powered-6g-networks-will-reshape-digital-interactions/"> Artificial Intelligence</a> and <a href="//www.sciencedirect.com/science/article/pii/S1877050923000133"> Machine Learning</a>, integrating both in network optimization and management as well as self-driving, and intelligent network operations. It will also allow new technologies such as <a href="//ieeexplore.ieee.org/document/9387701"> Intelligent Reflecting Surface</a>, <a href="//www.insidequantumtechnology.com/news-archive/quantum-particulars-guest-column-quantum-technology-as-key-enabler-for-6g-wireless-communication/">quantum communication</a>, advanced network coding, or <a href="//ieeexplore.ieee.org/document/9376324">Integrated Sensing and Communication</a>.</p> <h3>But where and when will 6G be deployed?</h3> <p>6G deployment should be faster than 5G, with the first deployment in the 2030s.</p> <p>In Asia, China's 14th Five-Year Plan (2021-2025) is aiming at strengthening research on new 6G network infrastructure as well as clarifying its technology requirements.<a href="//www.europarl.europa.eu/RegData/etudes/BRIE/2024/757633/EPRS_BRI(2024)757633_EN.pdf"> In the recently published</a> 'Three-Year Action Plan for the Industrial Innovation and Development of the Metaverse (2023-2025)', 6G is mentioned as one of the key technologies needed for the creation of a <a href="//www.gov.cn/zhengce/zhengceku/202309/content_6903023.htm">Chinese metaverse.</a></p> <p>Meanwhile, in South Korea, the Ministry of Science and ICT announced in February 2023 its K-Network 2030 strategy. Under this plan, the ministry will invest KRW 625.3 billion (around €440 million) in R&D projects and South Korea will host the <a href ="//amargoussustaub-my.sharepoint.com/_forms/default.aspx">'Pre-6G Vision Fest' in 2026</a>.</p> <p>In June 2020, Japan issued its roadmap to 6G. The 'Beyond 5G Promotion Strategy' provides funding for 6G research through three programs for a total budget of US$555 million (around €520 million). The Beyond 5G Promotion Consortium brings together representatives of Japanese industries and academic institutions to carry out research and development initiatives as well as advocate for 6G.<a href="//mediawireexpress.co.tz/japan-unveils-worlds-first-6g-device-20x-faster-than-5g/"> On April 11th, 2024, Japan launched its prototype 6G processor</a>. This milestone was the result of the joint efforts by <a href="//www.news18.com/tech/japans-6g-device-heats-up-global-race-coai-backs-indias-vision-to-bridge-generation-gap-8881827.html">Japan's leading telecoms NTT DOCOMO, NEC Corporation, and Fujitsu</a>.</p> <p>In March 2023, India released its 'Bharat 6G Vision'. The proposal aims to “design, develop and deploy 6G network technologies that provide ubiquitous, intelligent and secure connectivity for high-quality living experience for the world”. According to the proposal, a total pool of INR10 000 crore (€1.1 billion – raised through instruments such as loans, grants, and venture capital funds) is expected to be invested over the next 10 years in R&D projects developing <a href="//www.europarl.europa.eu/RegData/etudes/BRIE/2024/757633/EPRS_BRI(2024)757633_EN.pdf">India's 6G ecosystem</a>.</p> <p>In Europe, the EU funds the<a href="//hexa-x.eu/consortium/">Hexa-X</a> project, a consortium composed of 25 organizations from 9 countries: Finland, Sweden, Germany, France, Italy, Spain, Greece, Turkey, and Hungary. Nokia and Ericsson lead the project. Siemens, Atos Spain, and Intel Deutschland bring in capabilities on AI, network orchestration, and special purpose solutions. Academic and research organizations provide the necessary scientific skills and research in B5G/6G topics, while SMEs provide skills in orchestration, AI, and channel modelling. This project focuses <a href="//www.ericsson.com/en/blog/2023/10/hexa-x-and-data-protection-evolution-in-6g">“on exploratory research for the next-generation mobile networks with the intention to connect human, physical, and digital worlds with a fabric of technology enablers.”</a></p> <p>The consortium has 4 objectives:</p> <p>Objective 1 aims at developing the 6G fabric and Key Value Items “for a vision of connecting intelligence, sustainability, trustworthiness, inclusion and extreme experience”. Objective 2 will deliver “extreme performance by developing and assessing key radio technology components for the next generation, through higher bands and localisation/sensing”. Objective 3 will “deliver methodology, algorithms, and architectural requirements for an AI-native network, through AI-driven air interface and AI governance”. Objective 4 will “deliver enablers for an intelligent network of networks, through network disaggregation and dynamic dependability”. For more details on each objective see <a href="//hexa-x.eu/objectives/">here</a>.</p> <p>On the other side of the Atlantic Ocean, <a href="//www.whitehouse.gov/briefing-room/statements-releases/2024/02/26/joint-statement-endorsing-principles-for-6g-secure-open-and-resilient-by-design/">in February 2024</a>, the US and several of its international partners endorsed shared principles for developing 6G declaring their intention to adopt relevant policies in the US, and “encourage the adoption of such policies in third countries, and advance research and development and standardization of 6G networks. As explained by the French government, one of the signatories, “(…) <a href ="//www.entreprises.gouv.fr/fr/presse/espace-presse/6g-la-france-et-partenaires-internationaux-s-accordent-sur-des-principes-communs-pour-developpement">this declaration commits signatory countries to adopt policies and a framework for connectivity for the networks of the future that is open, free, global, interoperable, reliable, resilient and secure for a more inclusive, sustainable, secure and peaceful future. The development of future networks and 6G will make it possible to respond to the challenges linked to the evolution of digital uses such as the massive use of artificial intelligence (AI) which requires the processing of ever-increasing volumes of data, or the development of critical applications, particularly in industry or health which require ever lower latency times. On both sides, States and economic players are preparing for the deployment of the networks of the future. To guarantee a secure, innovative, and resilient network, it is essential to establish an international 6G standardization framework”.</a></p> <p>Finally, in May 2023, Brazil announced an investment of BRL60 million (€11.4 million) in the competence centre responsible for the development of 5G and 6G <a href="//www.europarl.europa.eu/RegData/etudes/BRIE/2024/757633/EPRS_BRI(2024)757633_EN.pdf">(INATEL).</a></p> <h3>And what about the impact of 6G on companies?</h3> <p>6G will revolutionize the wireless communication landscape. Its speed, bandwidth, capacity, and latency will significantly impact industries and individuals. Indeed, 6G will allow for instantaneous communications between devices. This means that 6G will transform the way companies process information, communicate, and make decisions.</p> <p>One professional environment that will benefit from 6G is the Metaverse. The 3-D-enabled digital space uses virtual and augmented reality, for people to have lifelike personal and business experiences online. It will greatly benefit from 6G improvements in bandwidth utilization, data delivery, and application enablement. Indeed, the data and volume required for the metaverse applications present a significant challenge in data acquisition, security, and sharing, which can only be addressed with 6G.</p> <p>These improvements are especially important as <a href ="//metavers-tribune.com/le-marche-des-metavers-dune-valeur-de-900-milliards-de-dollars-nexistera-pas-en-tant-que-plateforme-unique/">the metaverse is expected to be worth $900 billion by 2030.</a> This is because the Metaverse will allow for bigger online meetings, 3D avatars, and better visualization of body language. Companies will also be able to offer new experiences to their employees, such as faster training programs, visiting prospects in their virtual world or facilitated remote work.</p> <p>However, companies will have to significantly adapt their strategies and in particular their digital marketing and customer experience strategies. This is shown by the <a href="//www.gucci.com/fr/fr/st/stories/article/gucci-gaming-roblox">Gucci Garden Experience</a> on the Roblox metaverse, which was visited in 2021 by more than 20 million visitors in two weeks. This led the luxury brand to open “The Gucci Town”, a virtual town where customers had the opportunity to dress their avatars in Gucci <a href ="//www.lesechos.fr/partenaires/ey-parthenon/metavers-quelles-opportunites-pour-les-entreprises-1851718">clothes and which was visited by 54 million players daily</a>.</p> <p>The impact of 6G on companies will also be significant in the manufacturing industry with companies having access to software predicting clients’ needs based on past orders, as well as in the healthcare industry that will be able to switch from a reactive to a predictive approach, with smart sensors collecting data, analysing information, making recommendations, and predicting health issues before they arise.</p> <p>6G will thus have a very broad impact on companies and their employees, and although its deployment is not taking place before a few years, it is important to already understand its strengths and potential for change. Indeed, it is likely that the closer we will get to the deployment of 6G, the more innovative uses and challenges will be revealed.</p> </div> </div>

Read More >>

.png)